top of page

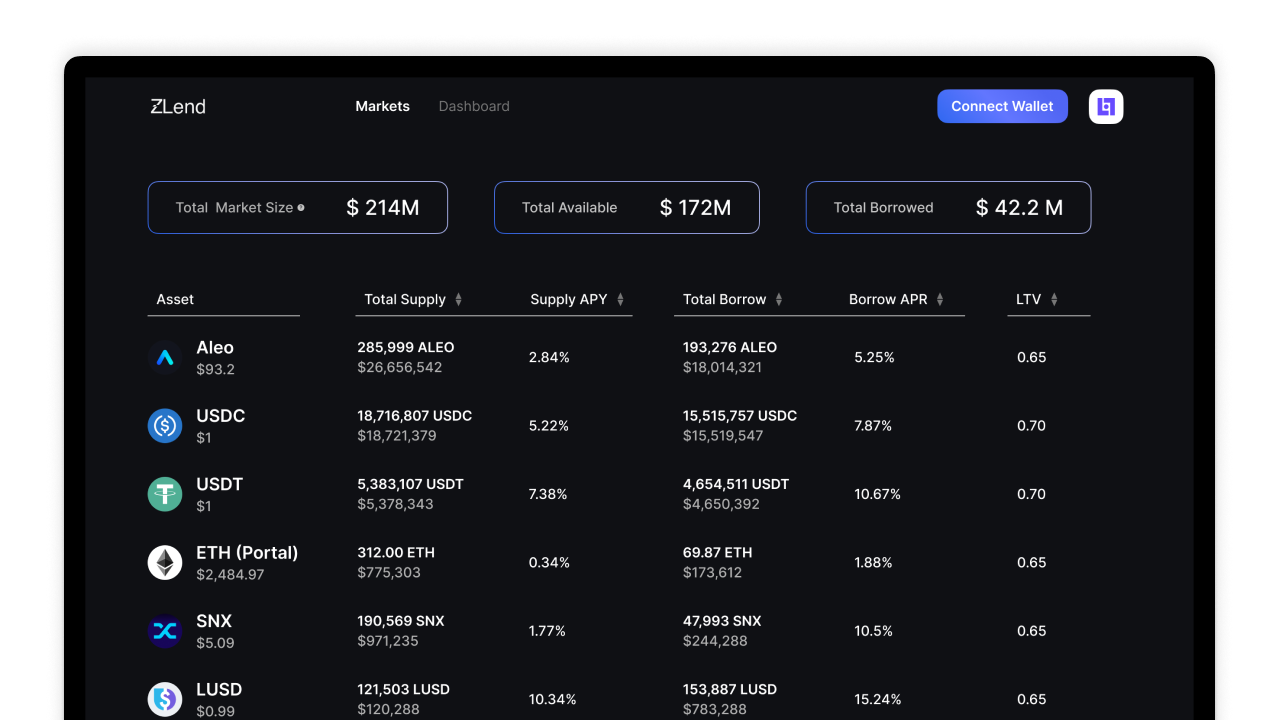

Finance Lending Protocol to Boost Productivity

Foster the safe trading with understandable reference data

Contributions

UI/UX Design, Research, User Flow, Persona, Figma

Meet My Team

DevOps, Developers

Time

2024 (3 weeks)

My Role

End-to-end UX design of the lending protocol

I led the end-to-end UI/UX design of the lending protocle. I collaborated with DevOps and developers. I was responsible for mapping user flows, designing transaction flows, and ensuring data privacy and clarity throughout the process.

Project Overview

Transparent, Trustless Crypto Loans

1. Aleo ZLend provides a unique Web 3 lending experience with understandable reference data

2. Aleo ZLend is a way to borrow and lend cryptocurrency on a trustless basis. This means that you do not need to trust the other party in the transaction. The Aleo blockchain guarantees the security of the loan

Problem Statement

The Transaction Process was not Intuitive and Understandable

Lending platforms must balance compliance with user experience. Regulatory confirmation steps can create cumbersome flows, especially for key transactions. Our focus on clarity streamlines the process, empowering users to easily navigate lending protocols and complete transactions.

Research Insight

Relevant Parameters Must Provide Safe Value References and Warnings

Our initial internal version provided extensive data but lacked understandability. The safe value and maximum value are the most crucial reference indicators. While other data is relatively important, users still had to calculate the safe and maximum values themselves. By displaying real-time safe and maximum value indicators, users can save 36% of calculation time.

Iterations

Reduce Users’ Cognitive Load

To understand how different means of indicators presented will make the dashboard more intuitive and understandable, I came up with different ideas to evaluate the pros and cons of each approach.

Solution

Static Indicator Reference

In the end, our team adopted Static indicator reference with floating action box, and clearly marked the threshold prompts and related explanations.

Outcomes

Boosting Efficiency and Trust in Web3 Lending

-

Improved efficiency by reducing users’ calculation time by 36%, enabling faster and more confident lending transactions

-

Increased user trust and adoption through transparent risk indicators that lower the learning curve for new users

Reflection

UX designers still have to tag the key indicators for mature users

By providing key reference data, users would be able to make trading decisions intuitively, but in fact users will need to be prompted at the threshold level.

bottom of page